Gregory P. Bufithis, Esq.

Founder/CEO

21 October 2015 – You just cannot make this stuff up. With a hat tip to my buddy Tyler Durden who tracks the hedge fund industry, plus another friend at the FT. And, no, not the “Tyler Durden” character from “Fight Club”.

I found the following story hysterical. The entire global financial system seems riddled with systemic fraud … and incompetence. I think it’s why we love the financial industry … well, as lawyers. More business for us.

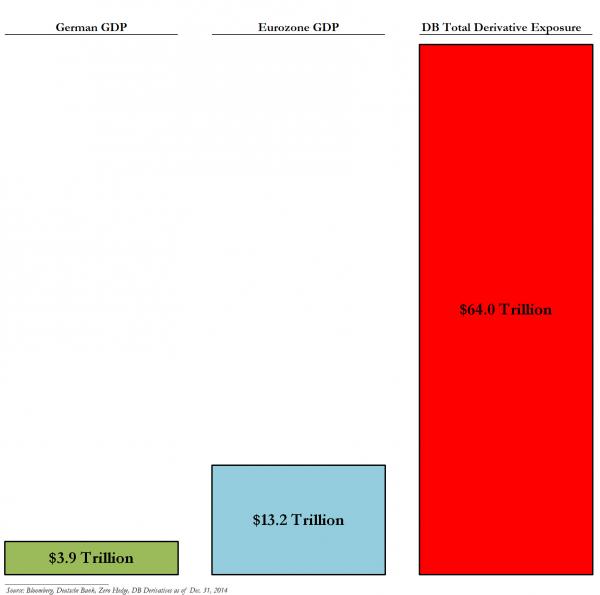

So just a day after flailing, scandal-ridden Deutsche Bank shocked investors with the latest corporate restructuring, the Financial Times reported another epic snafu involving the German megabank (with over $60 trillion in derivatives), which revealed that this past summer the bank “mistakenly” paid a hedge fund client $6 billion in a wire transfer “fat finger”.

Note: in the industry “fat finger” refers to a typing error on a trade order. You will recall my story from two years go about the “snoozing clerk” who was holding down the “2” key and turned a 62.40 euro transfer from a pensioner’s account into a 222,222,222.22 euro transaction.

The FT article is behind a pay wall so to summarize: according to the FT, the bank recovered the money from the US hedge fund the next day but, as it also notes, “the incident in its London-based forex team was an embarrassing blow for the bank, which is already under intense scrutiny from regulators.” And the reason for the fat finger? The intern … yes, intern, though called “junior trader” in the FT piece … did not know the difference between net and gross. The $6bn trade was processed while his boss was on holiday, according to two people familiar with the matter. Instead of processing a net value, the person processed a gross figure. This meant the trade had “too many zeroes”, said one of the people.

And yes, “too many zeroes”, as everyone knows, is the technical financial term for “you really screwed up”.

Now, I am fairly well versed on banking procedures and protocols having spent all that time on the Société Générale/Jérome Kerviel case some years back (for my series of posts on the case click here) so my logical question is why not a single alarm went off before the “fat fingered” wire transfer was concluded. Quoting the FT article: “the $6bn error raises questions about why it was not spotted under the bank’s “four eyes principle”, requiring every trade to be reviewed by another person before being processed.”

The answer is that there simply is no supervision and no safeguards when it comes to such gargantuan sums of money flowing around. The bank reported the incident to the US Federal Reserve, the European Central Bank and the UK Financial Conduct Authority. The FT said two people familiar with the trade said such mistakes were surprisingly common, but ones of that size were rare. Deutsche declined to comment. In other words, with one fell swoop, a “junior banker” could singlehandedly have pushed the bank into insolvency had he dealt with a hedge fund that was not quite as willing to part with the outsized “gain.”

The news explains why after surging on the latest round of disappointing restructuring news, DB’s stock promptly plunged in what some may say was another “fat finger” but was clearly exasperated sellers saying goodbye to a bank which clearly has no internal controls.

Wow. Thank goodness that while “fat fingers” like that are “surprisingly common”, DB’s gross derivatives position is stable: