The event industry has its Napster moment

All types of business events are in danger of their revenue streams of tickets, sponsorships, memberships, and other types of fees being eroded. This is happening as the world gets used to digital formats and alternatives emerge to physical networking, matchmaking, and other tasks we get out of these events.

By:

Eric De Grasse

Chief Technology Officer

27 August 2020 (Serifos, Greece) – The vast, global events industry is going through its Napster moment through this pandemic, and is in denial on what this will do to it. That was the big take-away from a travel intelligence/event industry Zoom chat this week that focused on the travel/event intelligence business.

We attend and report on some of the biggest advertising, media and technology events in the world. With a 6-person video, graphics and reporter team are expenses are high. We work with the giants of the events industry such as RELX, Informa, Comexposium, Emerald Holdings, Clarion, Tarsus and others.

Everything about the underlying economics of this sprawling, diverse, chaotic and highly profitable sector is being undercut by the move to virtual, and 2019 may be the year where the industry’s revenues peaked. This year could be the event industry’s 2000 moment à la what happened to the music industry.

I was there during the music industry’s “Napster moment” in late 1990s (I was working at a one-time Internet giant CMGI which was the most successful incubators of Internet companies before it flamed out). Those were the “vast promise years” of early internet. Rafit Ali (one of the Zoom chat presenters) was more directly involved. He wrote hundreds of stories about what happened to labels and the economic structure of music industry and music acts due to the development of Napster.

NOTE: Music piracy site Napster still exists. It was just sold to a virtual reality events company.

I remember those years more as a consumer. We were treated to the atomization of the album into singles and the new download boom which would give rise to Apple’s iTunes in 2001, and then the start of the streaming boom that led to Spotify and others since.

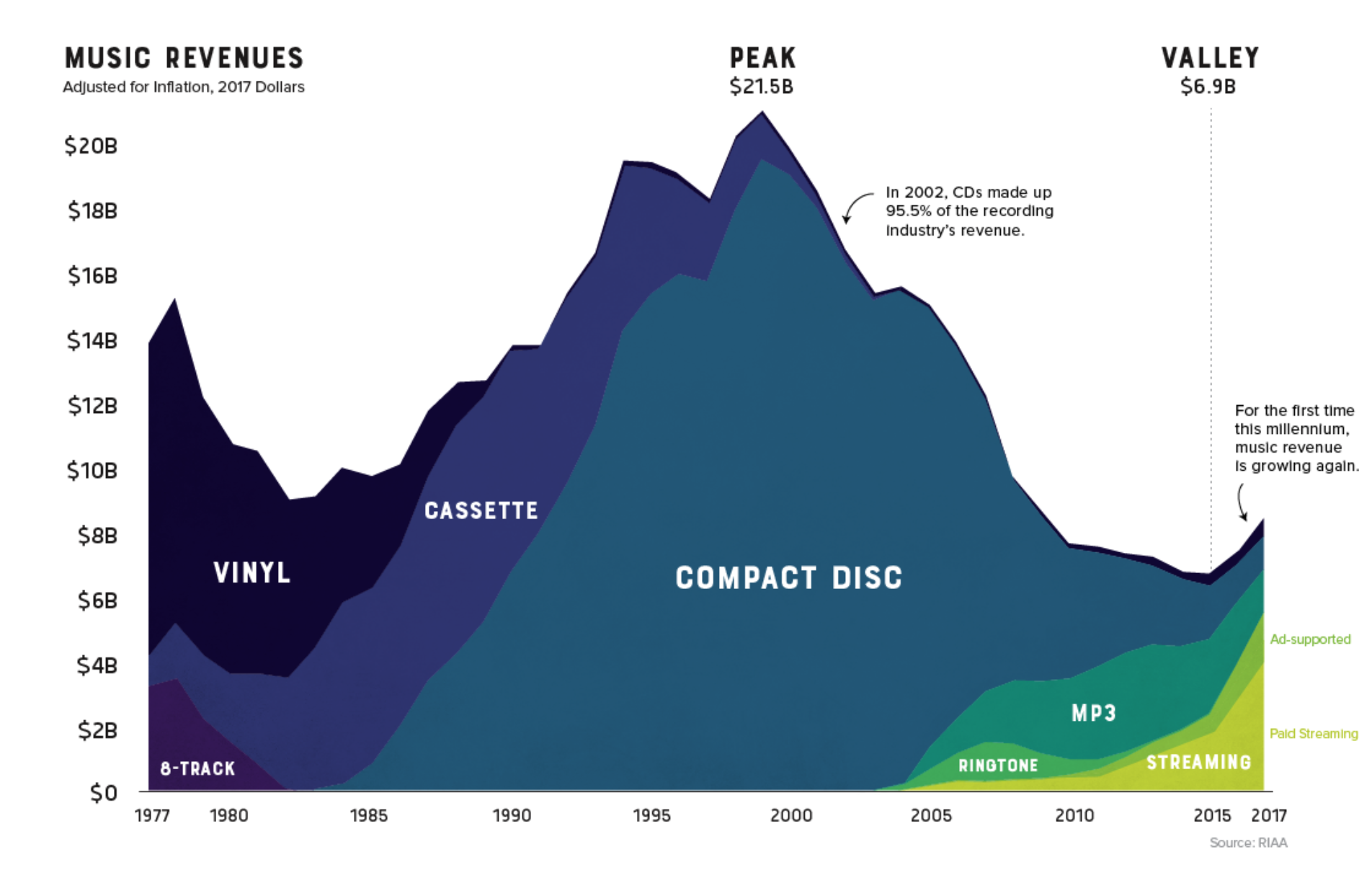

Rafit had us look at this chart to show the effect of Napster:

He said:

Look at what happened. It completely changed the makeup of the music industry, changed the radio industry along with it, lead to the rise and fall of satellite radio sector, led to a boom in live concerts. It changed how artists got discovered and YouTube’s outsized role in it, and many other innovations that came along that led us to the all-the-music-at-your-fingertips nirvana the listeners are in now. So many jobs were lost, billions of dollars went out of the industry and changed how everything gets done in the sector. It took 15 years for the industry to start growing again, it took 15 years till Spotify and other streaming services became good enough as a service and got adopted widely enough.

My partner, Greg Bufithis, has written scores of stories about the early 2000s and the gradual economic decimation of the newspaper industry due to the internet. It had become the primary mode of news distribution – and it didn’t learn the lessons from what happened to music just a few years prior. There was so much information flowing out there, but the newspaper industry remained analog in an increasingly digital world. And, frankly, it was tough to index all that information.

In fact, when Greg and I hooked up in 1999 and compared our experiences, I developed a bot similar to WebCrawler (the first bot to index web pages, created in 1994 by AOL) that tracked the news and cross-learnings from then disparate but semi-related industries of news media, information, entertainment and other related sectors that now get lumped together under the term “content” industry. The bot is in its 15th generation and still used by Greg.

And we are seeing it again. As Rafit put it “Zoom is the Napster of the event industry”. What he means is the ease with which you can put on good-enough virtual events with a global audience, almost for free, much to the undercutting of the underlying economics of the physical events world. All types of business events – conferences, trade shows, conventions – are in danger of their revenue streams of tickets, sponsorships, memberships, and other types of fees being eroded as the world gets used to digital formats and alternatives emerge to physical networking, matchmaking and other tasks we get out of these events. Rafit:

Billions of dollars have been sucked out of the industry this year as it is completely shut, and virtual is making up only a tiny fraction of that.

Jack Tarsig of Comexposium estimates that, on average, and in the best case scenario, virtual one-day events bring in only about a quarter to a third of what a physical conference revenues used to pre-pandemic, and while that is one example and “your mileage will vary” from industry to industry, company to company, and event to event, it’s very likely revenues from digital events will never get close to offline events.

• We are habituating the business world to free or almost free events where we used to charge thousands of dollars for conferences and other business events.

• We are habituating sponsors to pay up a fraction of what they used to pay, with more precise targeting that online tech and tracking allows.

• We are habituating a world to less business travel, a world that is arguably better and happier without so much weight of people criss crossing the planet and countries.

• The giants of the events industry are estimating that about 10 to 15 percent of business travel demand may leave the market permanently, and it may also lead to the death of single-meeting business trips, all of which will have direct and indirect implications for the events industry.

If you think Zoom and virtual event tech today are clunky, think about the Spotify comment above: it took 15 years to perfect the software. The current crop of virtual event software companies – most of them new companies, all of them clunky and prone to malfunctioning in live events – are the Musicnet and Pressplay of the event sector (you really have to be a music industry insider to know that reference) – those early software companies promising the moon on digital music but that were really just the 0.1 version of the revolution to come.

Yes, the face to face interaction of meetings will always have a preeminent place at events. I did four on-site events this year before COVID-19 hit, and I have done four virtual events. Virtual “meet ups” are just not the same. But so much tech on this is still to be built but being built. And there is so much left to do on online matchmaking, the biggest aspect of conventions and exhibitions, but it will happen. Much like online/mobile dating was unthinkable until the 2000s and then the matchmaking aspect of it moved completely to digital channels, so could the matchmaking part of the events industry, in fact it would necessarily be lot more efficient that way.

I expect the next five years to bring lots of new interaction tech into existence, some of which we can’t even imagine now. Sam Mobry of RELX reminded us of this (widely mocked) hologram anchor used in the U.S. Presidential election night in 2008:

It disappeared but a much better version of this hologram is in the works for hybrid offline/online events in the years to come. One new model is expected to debut at the Mobile World Congress virtual event in 2021.

Which brings us to the business structure of the events sector. What will happen to the giants of the events industry I mentioned above … RELX, Informa, Comexposium, Emerald Holdings, Clarion, Tarsus and others … and all the event organisers around the world. How will they respond to this change in their core businesses?

Some of them had already diversified their holdings beyond events into information services and other subscription focused services over the last decade. But what will happen to the events business of media publishers, one of the till-now-fast-growing lifelines they have developed in the last decade through the decimation of their ad-supported business lines? What will happen to the legion of event production companies, event professionals and other front and back of the line employees that make their living through putting on the logistics-heavy events around the world? What happens to venues in a digital first or at best hybrid world? How will convention and group business-led hotels fare through this as they rethink their reason for existence? What will happen to convention & visitor bureaus of cities and regions and how will they reinvent themselves? How will convention cities like Barcelona, Frankfurt, Houston, Las Vegas, Milan, Orlando and others rethink their business mainstays?

Here are some common lessons that will potentially apply to the events industry as pulled from the Zoom chat:

• As soon as digital distribution and adoption is injected into the ecosystem – in this case everyone has been forced into digital adoption – it changes the underlying economics especially when it comes to the pricing power, in this case free or cheap events, and lots of them.

• The barriers to entry get lowered and everyone enters into it, the hype cycle comes in and a few years later the shakeout happens. Meanwhile billions of dollars move out of the incumbent sector and lots of jobs are lost.

• The events industry never comes back to the former glory in older formats. When it does come back to dollars, newer players like Netflix reformat the whole industry.

• New disruptors emerge and larger companies go through lots of short term pain but most likely win out long term – in many cases by gobbling up the disruptors – if they have internalized the lessons of other industries.

• Lots of incumbent intermediaries in the industry get swept aside and the buyer and seller side go direct, until it doesn’t work or scale and new types of intermediaries emerge.

• Early innovators and disruptors mostly do not win long term, but the fast followers do.

• Incumbents have to be ready to cannibalize themselves to survive and thrive.

• Lots of innovation comes out that looks like gimmicks in the short run and are subsumed in subsequent industry cycles and become the norm.

• Whoever best controls the largest amount of data is the biggest winner. CES, Mobile World Congress, Frankfurt Book Fair, Cannes Lions – they hold a tsunami of data.

• Lots of new niches emerge, some become mainstream over a period of time.

• In the end, the end consumer always, always wins out. You can’t fight that force.

It is important to point out that neither the music nor radio nor the news industry nor the TV/film industry died. Its that the incumbent players were simply shunted aside by new companies without the institutional bloat and interests that nearly always keep incumbents from advancing to the next thing.

This much we know: connecting people in a business setting will always be a need, in fact may even be more important in a digitally overloaded world, whether through great content in a conference setting or through buyer-and-seller matchmaking in various formats.

Many aspects of the industry will likely move to digital formats but the need for physical interaction for the “last mile” may become even more important, even if it becomes a smaller venue where this happens. Lots of experimentation and openness to failing a lot would be key to success for current incumbents.

But is the event industry ready for this reality?