Avocat Reporteur

PROJECT COUNSEL MEDIA

9 October 2020 (Brussels, BE) – Of the 33 top 50 UK firms to confirm their use of the UK Government furlough scheme since it was introduced in March, 30 pushed up revenue at the 2019/20 year end and of those 30 firms, more than a third (nine) saw revenues rise by more than 10 per cent. At the same time, average profit per equity partner rose at 13 of the 33 furloughed firms, the highest rise was at Withers which, at its peak, had 54 people on the furlough scheme but saw PEP skyrocket by 39.6 per cent from £359,000 to £501,000.

Yes. The Lawyer has been cranking out the numbers – again.

With clients keeping a closer eye on how firms have treated their people this year, the moral conundrum facing partners and their leaders now is whether to follow the lead of Hogan Lovells and Travers Smith to self-fund their furlough schemes or risk reputational damage by hanging on to the taxpayer-funded alternative.

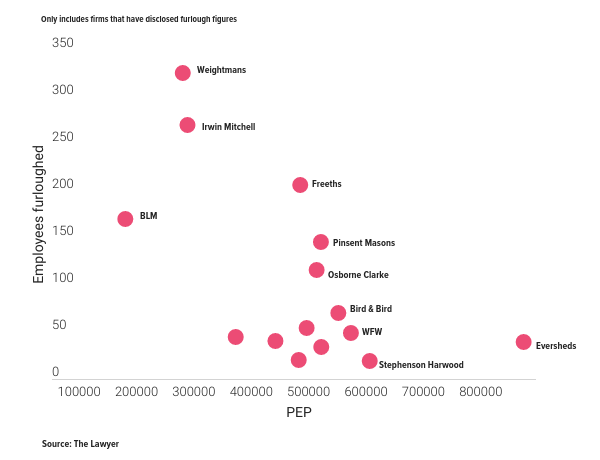

So far, seven Top 50 firms have put more than 100 people on furlough over the course of the scheme, the largest of which was at Weightmans which at its peak had 326 people on furlough. Weightmans partners had their drawings cut by 20 per cent in the spring while profit distributions were deferred. But the firm didn’t cancel its bonus pot and when revenues went up 6.3 per cent to £103.4m at the year end, it resumed profit distributions and ditched the 11 per cent salary cut it introduced earlier in the year.

Freeths recorded double-digit revenue growth (its second consecutive year of 14 per cent growth to £102.8m) while average PEP rose 5.5 per cent to £484,000, yet the firm put 206 people on furlough. Earlier this week, Freeths concluded a redundancy consultation which initially put 80 positions at risk and resulted in 30 roles being cut, including 19 lawyers.

Further up The Lawyer rankings, both Osborne Clarke and Pinsent Masons have been prolific furlough users, with 116 and 146 people placed on the scheme respectively. At last count Pinsents had already brought 46 people back while Osborne Clarke wanted everyone back in August. Pinsents’ revenues were up 2.8 per cent to £495.9m, with profit distributions and bonus awards brought back into play. Osborne Clarke, meanwhile, promised to reimburse a 7 per cent pay cut imposed on those earning £30k-plus if they hit their targets this year after lifting revenue by 3.6 per cent to £278.4m. The firm maintains reduced distributions, however, and PEP dipped by 10.1 per cent to £510,000 in April.

The story is the same across the top of the profession – Ashurst, Herbert Smith Freehills, Eversheds, Norton Rose Fulbright – none have had a terrible year but still benefitted from the furlough scheme. The latest figures from HMRC show that of £35.4bn claimed under the scheme to 16 August, £215m had been repaid by employers. The question now is whether the top performing firms should follow suit.