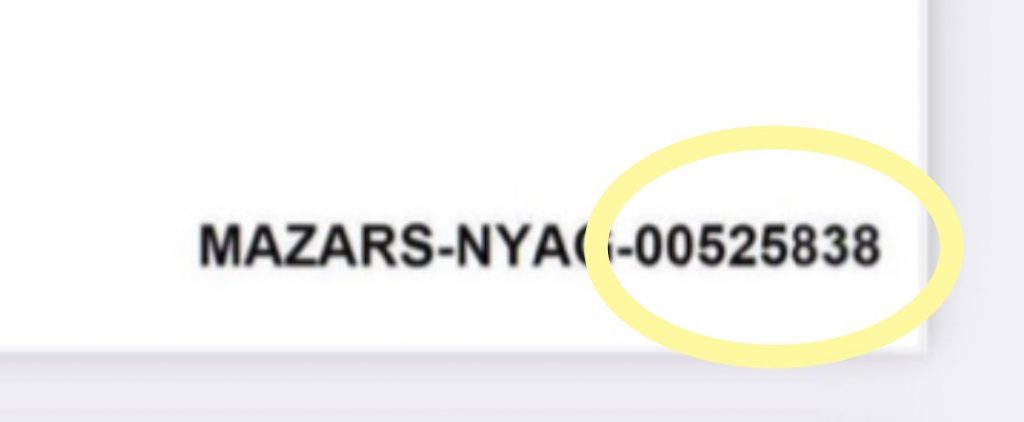

It suggests that the accountants have produced at least 525,838 pages of material to prosecutors.

The amount of forensic accounting that went into that is incredible. It somewhat explains why the New York AG has taken its time to get all the ducks in a row.

BY:

Salvatore Nicci

Technology Analyst / Reporter

PROJECT COUNSEL MEDIA

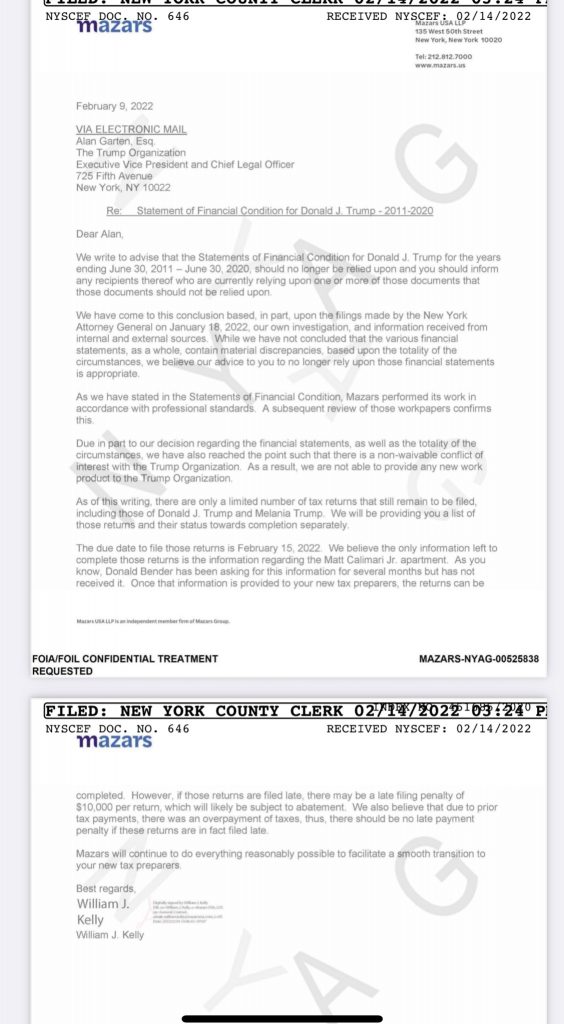

15 February 2022 (New York) – Social media was on fire last night as it was revealed that the New York State Attorney General submitted a court filing regarding its investigation of Trump financial affairs. It is a letter from Trump’s company accounting firm saying nearly a decade worth of financial statements can no longer be relied upon.

FYI: it’s only 10 years of financial/tax documents because some statutes of limitations kick in.

The letter follows and as you read it I think you’ll come away with my view: the letter is very carefully drafted, and clearly Mazars has some concern about its own exposure. The first basis named for the retreat is the New York AG investigation:

And somewhat comical: I find it a bit strange that Mazars has just now figured out that the information that they have been providing is not reliable – only after someone came asking about or looking into it. The statement “Mazar performed its work in accordance with professional standards” is not supported by the rest of the document.

So Mazars is wiping their hands clean. The line about “have not concluded there are material discrepancies” is important since if they do ID material changes, it could trigger loan covenants or insurance policy drops.

I asked several U.S. accountants if all of this means they are equally culpable in that they did not prepare financial statements in accordance with proper general accounting standards or principles, or if they are shady at best and really falsified some conclusions that led to banks providing loans based on wrong info. They noted the following:

• Unless outright fraud by the accountants can be proven most of the accountants said they’re protected under a sort of “garbage in garbage out” provision. The accountants can “presume” that the numbers they were given were real, and then they do “accounting stuff” with those numbers.

• Although all the accountants noted this could trigger Trump’s lenders to put his loans in default for being out of compliance on his loan covenants (if these specific financial statements were listed in his loan documents).

• There is a caveat at beginning of most audits explaining that they believe information is reliable based on information presented to them by management. They are now retracting that, essentially saying they were probably lied to.

• Several said professional obligation means being reasonably sure that the data to which they are attesting isn’t a steaming pile.

• Several said they were not sure about the accountants’ role based on the letter. If they were just preparing financial information they are using the records they are provided and make no assurance it is accurate. It depends on the service they were engaged to provide. They may have only “Compiled” the financials from information they were provided. Or they may have “Reviewed” them or “Audited” them. A Review or Audit service would be very problematic for Mazars.

Frankly, I do not buy the idea the accountants did not know fraud was afoot but I do read the letter as follows:

• “decision regarding the financial financial statements” = they are false because you lied

• “totality of the circumstances” = the NY D.A. is serious

• “not able to provide new work product” = sorry we’re not going to jail for you

• “non-waivable conflict of interest” = we are now on team NY D.A.

And this last point brings me to that Bates number on the accountant letter. As we all know, Bates numbering (also known as Bates stamping, Bates branding, Bates coding or Bates labeling) is used in the legal, medical, and business fields to place one or more of identifying numbers, date and time marks on images and documents as they are scanned or processed, for example, during the discovery stage of preparations for trial or identifying business receipts. Bates stamping can also be used to mark and identify images with copyrights by putting a company name, logo and/or legal copyright on them. This process provides identification, protection, and automatic consecutive numbering of the images.

I spoke to Dennis Worrell, an attorney who had once worked at the New York AG office via an outside legal vendor and he said:

“Yes, it means the accountants have already turned over 500,000+ pages of documents to the NYAG’s office and the NYDA’s office. I know that process, that procedure. I did it many times in the AG office, and on other assignments.

It also means to me the accountants have been working with the New York state prosecutors since 2019 when they were first subpoenaed to turn over personal and corporate financial statements. And they did this cooperation quietly, out of view of the media. People have been focused on the Federal investigations of Trump and have not paid much attention to the New York State proceedings. And now as the media starts to examine the NY AG’s other court filings more closely they’ll find other people and entities that have been providing them information, with lots of interesting Bates stamping”.

As for the politics, I am certainly no expert on American political machinations. But I recall that just over a month ago, U.S. Attorney General Merrick Garland said “no one is above the law”. So far we only have his word on that while the clock on the obstruction of justice charges Robert Mueller gave the U.S. DoJ – all practically “ready to file” – are close to timing out.

On the other hand, New York State Attorney General Letitia James is fearlessly walking the walk. A small ray of light in a country going darker and darker by the day.